michigan sales tax exemption number

If you have quetions about the online permit application process. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Tax Exempt Form Wayne State University

Once completed you can sign your fillable form or send for signing.

. General Information on State Sales Tax. Exemption entities may complete the. What is your tax exempt.

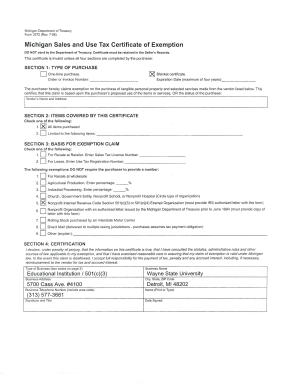

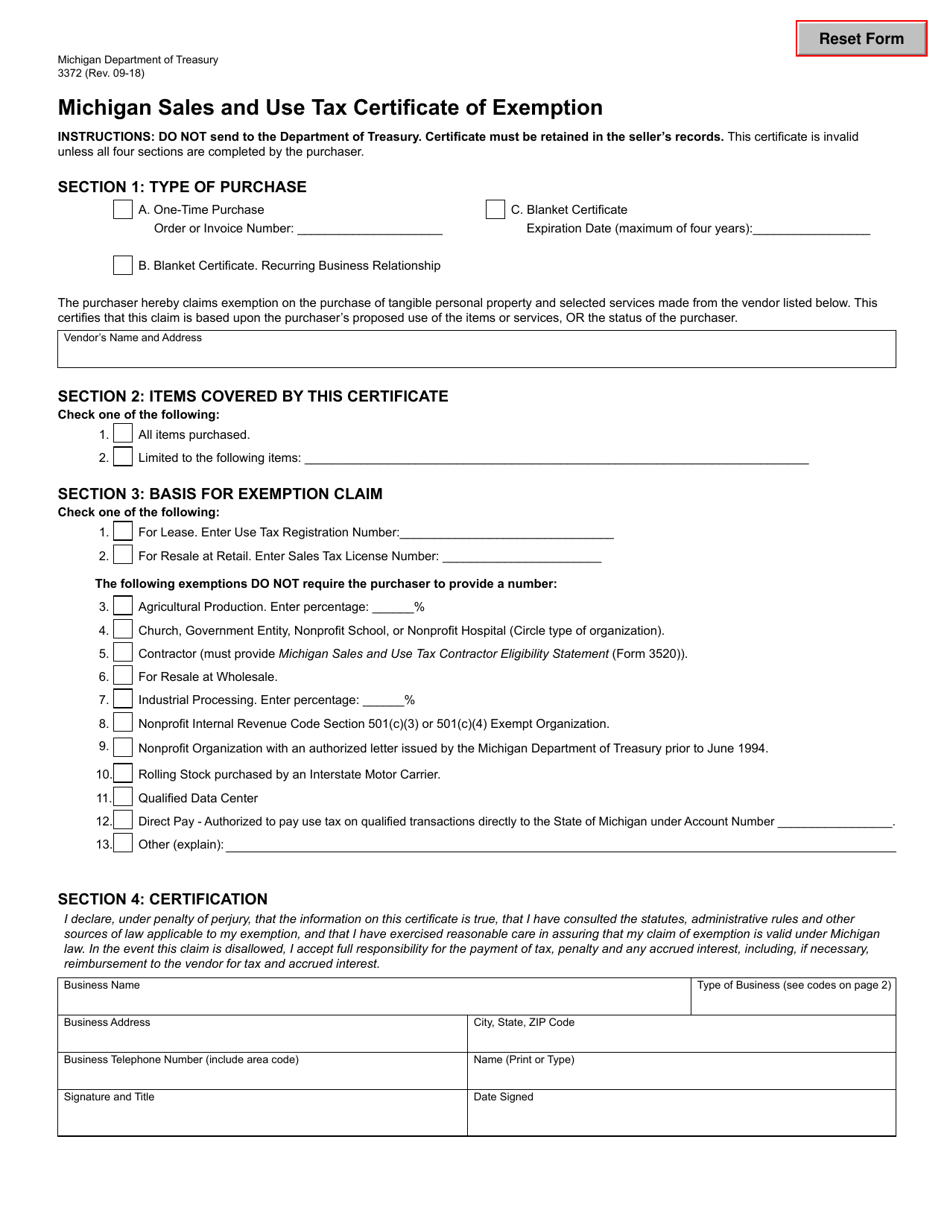

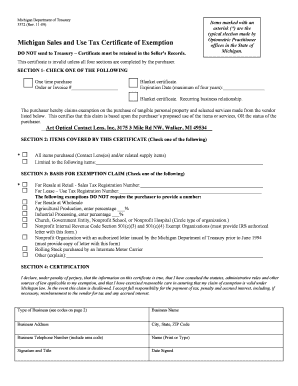

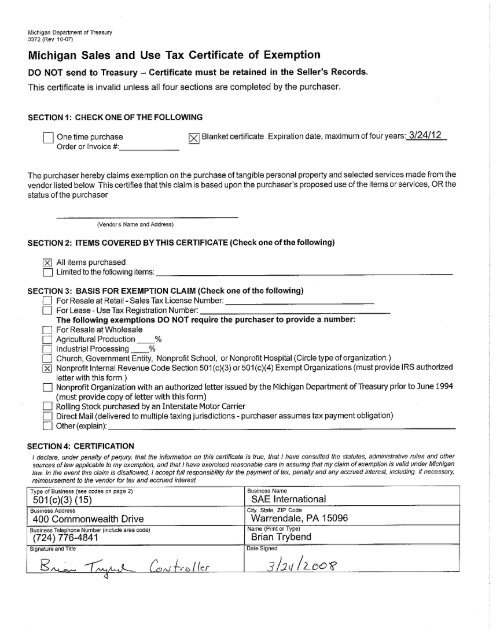

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. A Resale Certificate is obtained by filling out Form 3372 from the Department of Treasury titled Michigan Sales and Use Tax Certificate of Exemption. Instructions for Michigan Vehicle Dealers Collecting Sales Tax from Buyers who will Register and Title their Vehicle in Another State or Country.

The Michigan Sales Tax is administered by the Michigan Department of Treasury. Michigan Department of Treasury Subject. In order to claim an exemption a wholesaler must provide the seller with a completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption and indicate that the purchase is for.

To claim exemption for purchases the buyer must present the seller with a completed Form. All forms are printable and downloadable. Virtually every type of business must obtain a State Sales Tax Number.

2022 Sales Use and. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use tax.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Michigan Department of Treasury 5082 Rev. Michigan Department of Treasury Subject.

It is important to note that tax-exempt status is only. Once you have that you are eligible to issue a resale certificate. 3372 Michigan Sales and Use Tax Certificate of Exemption Author.

This means that the business or entity making the purchase is exempt from paying sales tax. 3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372. Sellers should not accept a tax exempt number as evidence of exemption from sales and use tax.

If your business sells products on the internet such as eBay or through a. Individuals or businesses that sell tangible personal property to the final consumer are required to remit a 6 sales tax on the total price including shipping and handling charges of. Sales Use and Withholding Tax Due Dates.

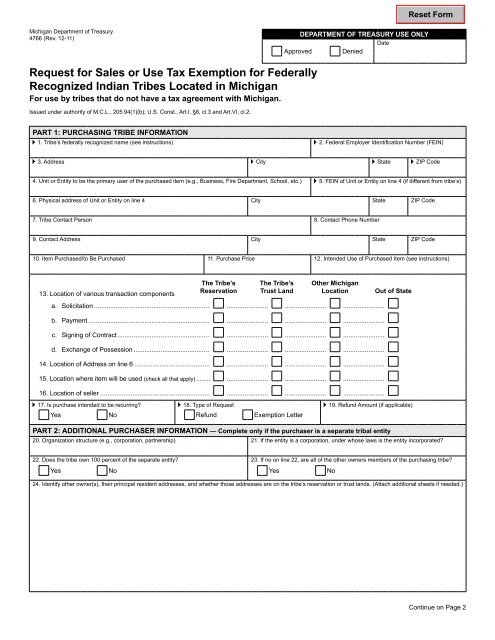

Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission. Streamlined Sales and Use Tax Project. You can learn more by visiting the sales tax information website at wwwmichigangov.

Refer to this guide for common reasons that a business would be exempt from. How to use sales tax exemption certificates in Michigan. 3372 Michigan Sales and Use Tax Certificate of Exemption Keywords 3372.

3372 Michigan Sales and Use Tax Certificate of Exemption Author. In completing the form feel free to indicate that you are seeking a blanket certificate on all items purchased that these are for resale at retail and be sure to include your Sales Tax. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form.

Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2. Notice of New Sales Tax Requirements for Out-of-State Sellers. Therefore you can complete the 3372 tax exemption certificate form by providing your Michigan Sales Tax Number.

Use Fill to complete blank online MICHIGAN pdf forms for free. This page discusses various sales tax exemptions in Michigan. 04-21 Page 1 of 2 Issued under authority of Public Acts 167 of 1933 94 of 1937 and 281 of 1967 all as amended.

Michigan does not issue tax-exempt numbers so sellers must have this form in order for you to be granted your tax-exempt status.

Michigan Sales Tax Exemptions Agile Consulting Group

4766 Request For Sales Or Use Tax Exemption State Of Michigan

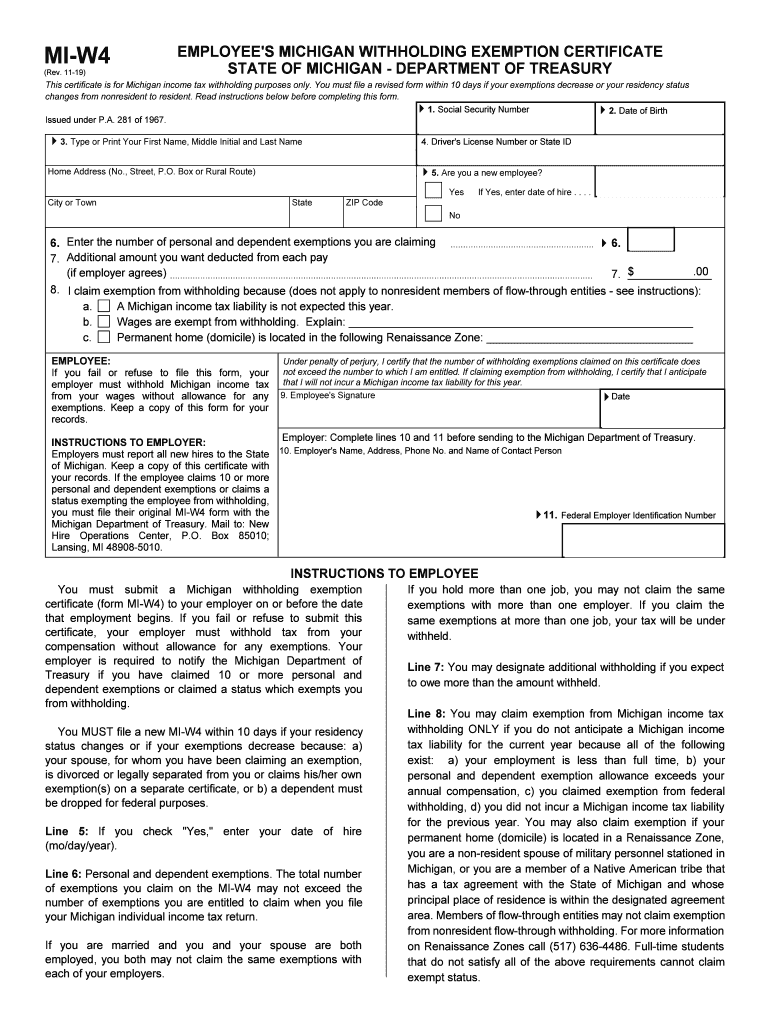

Michigan Withholding Fill Out Sign Online Dochub

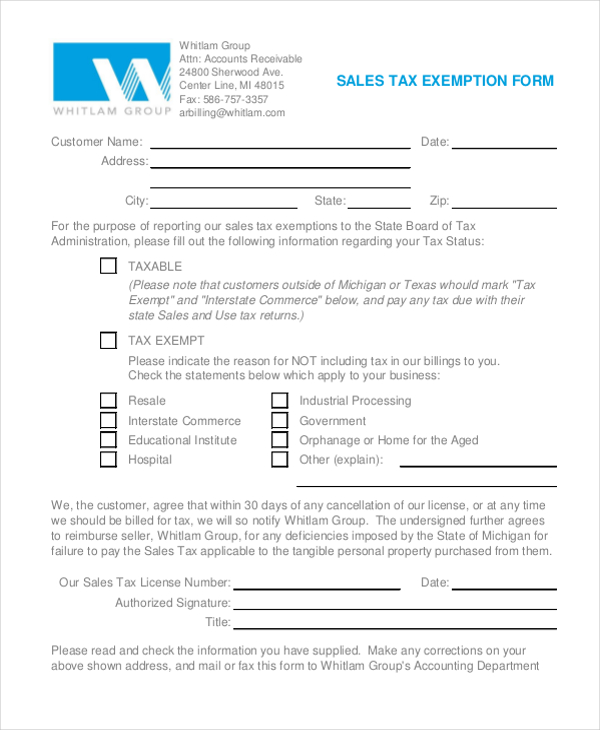

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Sales Tax Laws By State Ultimate Guide For Business Owners

Which Document To Submit Transpere Corporation Transpere Auction

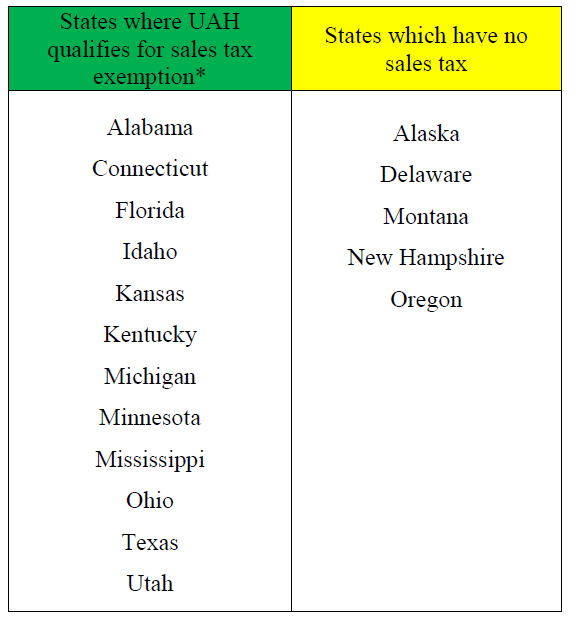

Uah Business Services News Tax Exemption Guidelines

Printable Michigan Sales Tax Exemption Certificates

How To Use A Michigan Resale Certificate Taxjar

How To Register For A Sales Tax Permit In Michigan Taxvalet

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Tax Exempt Form Detroit Pump Mfg Co Michigan

Printable Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

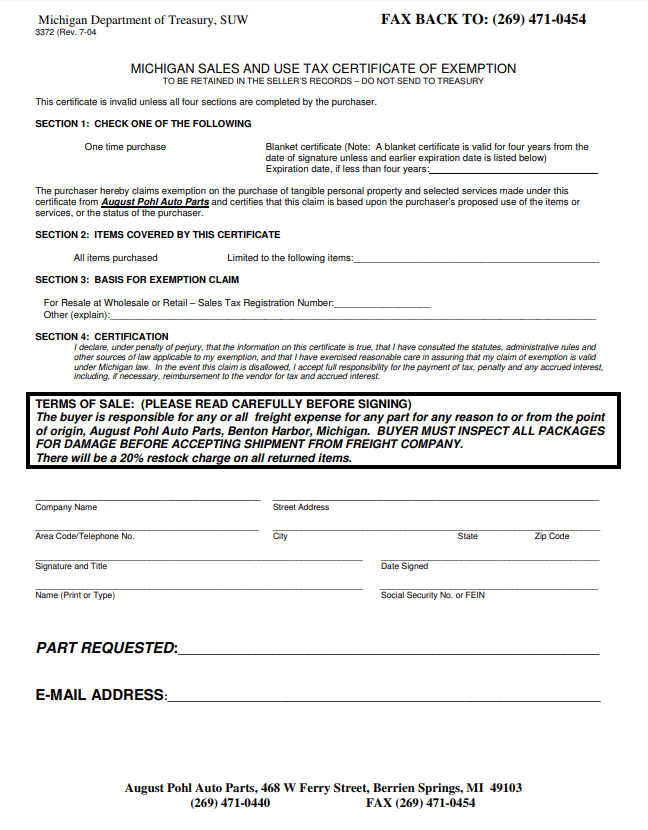

Mi Sales Tax Form August Pohl Auto Parts

Michigan Sales And Use Tax Certificate Of Exemption Students Sae